Introduction

Today’s job market has a reputation for being highly competitive, with candidates and recruiters alike feeling the pressure to be—or obtain—the ideal match for a company’s needs based on relevant experience. Because of the sheer number of qualified candidates in the application pool, it can be extremely difficult to bring the best candidates to the forefront and make hiring decisions appropriately.

That said, there is a way forward. In the same way sales teams utilize the sales pipeline (or funnel) to obtain opportunities, qualify leads, and close deals, HR teams can use a similar approach with a corresponding recruitment pipeline. The recruitment pipeline allows an HR department to parse through applications: selecting the best, ensuring they lead to interviews, and giving these candidates the potential to be hired. And that’s not all—the recruitment pipeline has provisions for following up with both successful and unsuccessful candidates to obtain feedback about the application process.

The following KPIs are essential for HR teams to use when tracking potential hires in the recruitment pipeline. They cover all aspects of the hiring process, and are presented here to approximately correspond with the order they appear in the pipeline. Best of all, it’s extremely easy to visualize KPIs such as these on data dashboards so your team can stay informed, engaged, and motivated. If you’re a recruitment manager or headhunter and want to know more—read on!

Common Recruitment KPIs

1. Hires to Goal

The number of new hires needed to hit quota.

In rapidly growing companies in a highly competitive market, assessing candidate quality and getting them hired as soon as possible is crucial for both short- and long-term success. After all, having enough people on hand to get the job done is the means to accomplish this! Keeping track of your Hires to Goal for every relevant period—whether quarter, half, or year—ensures you’re bringing in the talent you want (and need!) in a timely and efficient manner.

2. Time to Fill

The average time taken to fill a position, from the moment it is opened to the moment an offer is accepted.

When hiring candidates, it’s vital to know how quickly the hiring process is proceeding and how fast candidates are being recruited. This is what Time to Fill measures—important so that you’re not wasting excess time or money on the recruitment process. Unsurprisingly, a short Time to Fill means that your recruitment process is efficient, and a long Time to Fill indicates the presence of roadblocks along your recruitment pipeline. Across all industries, the average Time to Fill is about 42 days.

3. Applicant-Interview Ratio

The number of applicants it takes to find one qualified candidate who is invited to an interview.

The Applicant-Interview Ratio is all-important for understanding how selective your company’s screening process is, as it compares the number of applicants against the number of candidates invited to interview.

A high Applicant-Interview Ratio means that while your job posting looks appealing and is attracting a lot of candidates, your screening process is too selective and you could be missing out on some real talent. On the other hand, a low A-I Ratio likely indicates that your hiring process is too lenient—too many applicants are getting too far in the pipeline, and that you’ll simply have to be more selective in the future. While benchmarks vary significantly across industries, the overall A-I Ratio average is about 3 percent.

4. Interview-Offer Ratio

The number of interviews conducted to make one job offer.

HR teams use the Interview-Offer Ratio as a means to evaluate the candidate experience and ensure they’re attracting the right talent. If a recruitment team has a high I-O Ratio, it means a large number of interviews are being conducted, but few offers are being made. Root causes of this scenario can include unclear job descriptions, uncertainty on the recruitment team’s part about what they’re looking for, or a tight job market.

Conversely, a low ratio means that the job market is in seekers’ favor, or that your team’s hiring process is highly efficient. Keeping a low I-O Ratio is also a sign of high professionalism on the hiring team’s part: they know what they’re looking for, and are clear and upfront about the job description without being needlessly picky.

5. Offer Acceptance Rate

The percentage of job offers accepted by candidates.

The Offer Acceptance Rate is the candidate’s ultimate verdict on the hiring process: does the candidate want to join your organization or not? Companies monitor this KPI to see how candidates respond to the hiring process, and how successful they are at attracting candidates to sign on.

A high Offer Acceptance Rate is of course indicative of candidates receiving a highly positive impression of your company throughout the hiring process. However, a low Offer Acceptance Rate indicates recurring issues the candidate perceives—for example, an uncompetitive compensation package; a mismatch between the candidate’s qualifications and workplace expectations; or an overall unpleasant hiring experience. Generally speaking, a high Offer Acceptance Rate is considered to be at least 90 percent.

Build your first dashboard.

Start your 14-day free trial today

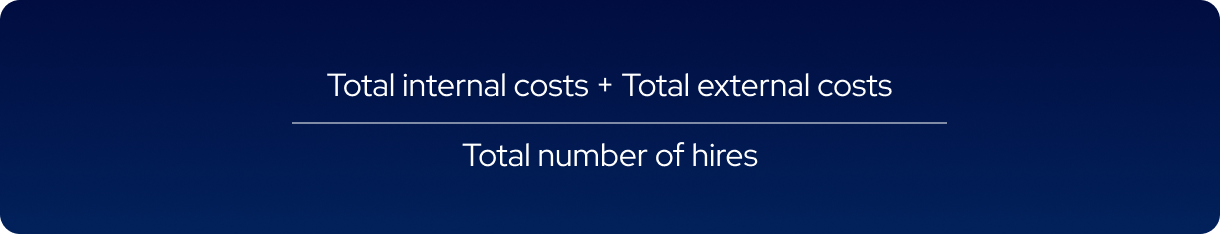

6. Cost per Hire

The total cost involved in hiring a new employee, including advertising, recruiting fees, and internal costs.

You can think of Cost per Hire as the HR version of CAC (Customer Acquisition Cost), as each measures the total costs that go into obtaining a single new unit, whether customer or employee. The costs included in Cost per Hire include all expenses incurred during the recruitment process: job postings, recruitment agency fees, employee referral bonuses, interview travel expenses, background checks, and any other internal expenses. In midsize companies across all industries, the average Cost per Hire is about $5400.

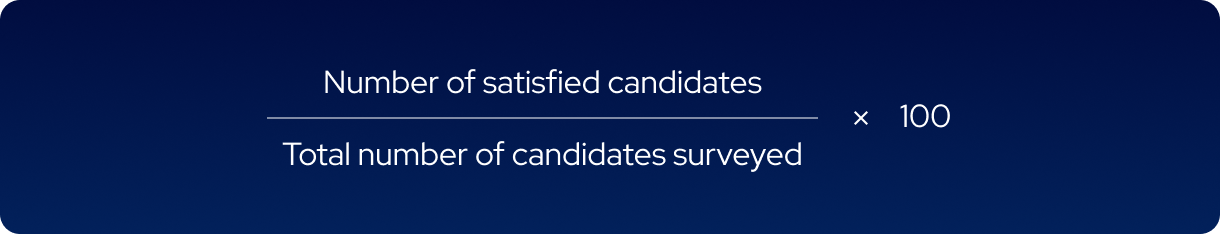

7. Candidate Satisfaction

The satisfaction level of candidates with the recruitment process, often obtained via surveys.

Often distributed as a survey following the hiring process to both successful and unsuccessful candidates, the Candidate Satisfaction KPI is the jobseekers’ version of CSAT. Measured as a percentage of “satisfied” candidates out of the total—those candidates who score the hiring process as an 8-10 or 4-5—there are several factors of the hiring procedure that affect the overall score. These include…

Communication

Candidates—including those who aren’t hired—receive timely and clear feedback from the employer about their application status and next steps

Transparency

The company provides clear information about the job role, responsibilities, company culture, and pay

Respect and professionalism

Candidates are treated with dignity and kindness throughout the interview process

Efficiency

The hiring process is streamlined and doesn’t contain unnecessary steps and delays

Overall experience

The candidate has positive interactions with recruiters, hiring managers, and other employees.

The company’s branding and competitive advantage in their market niche, coupled with the available talent pool, strongly influences candidate selection and their satisfaction with the hiring process. In the software industry, the average Candidate Satisfaction score hovers around 78 percent.

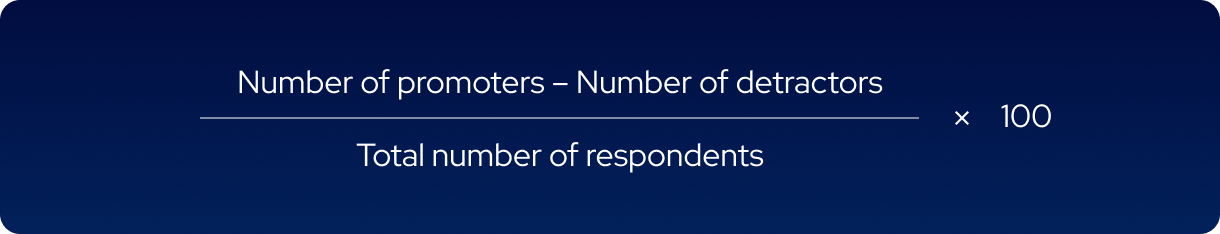

8. Candidate NPS

The likelihood of job candidates, whether hired or not, to recommend your company to others.

Candidate NPS is a riff off of the well-known (and well-used) NPS (Net Promoter Score) KPI. In both forms of NPS, job candidates (or customers) are asked, based on previous experience with the company, how likely they are to recommend it to others on a scale of 0-10. Those who say 9-10 are promoters, those who say 7-8 are passives, and those who say 0-6 are detractors. After the percentage of detractors is subtracted from the percentage of promoters, a score of -100 to +100 is revealed. A score of +1 or more is considered “good”—but of course your company should aim for much higher than that!

It won’t surprise you to learn that Candidate NPS can vary hugely between industries, so generalizing is something of a guessing game. Insurance firms and airlines tend to fare poorly in their C-NPS scores, usually coming in below 30. Meanwhile, software companies perform particularly well—for example, Apple’s C-NPS is 89.

9. Retention Rate

The percentage of new hires who remain with the company after a certain period.

Finally, Retention Rate. Another KPI with overlap in customer service, the candidate Retention Rate indicates how good your firm is at not only attracting new talent, but keeping it around.

Companies with good Retention Rates do what matters right: they have efficient and fair recruitment processes; they have clear expectations for the job and recognize employees who fulfill these expectations; and they have overall positive and supportive workplace cultures. For this reason, Retention Rate is closely tied to Candidate Satisfaction. Companies with less than optimal Retention Rates should isolate the issue in their corporate culture that’s driving recent hires away, and prioritize solving it to avoid the financial and social costs of too-high employee turnover.

A good Retention Rate across industries is considered to be between 35 and 84 percent.

Conclusion

In your HR team’s quest to stay on top of recruitment and retention, these KPIs will prove highly effective, as they’re able to quantify the discrete steps of the recruitment pipeline. Using them in conjunction with Plecto’s powerful visualization capabilities—both real-time or dynamic dashboards and TV screens—will streamline your candidate recruitment efforts, making them faster and more effective than ever.

Want to know more? Check out Plecto’s free 14-day trial offer, and sign up today!

JAMES NIILER

Content Specialist

An in-house content writer and specialist at Plecto, James brings an academic touch and journalistic flair to his marketing copy. Having worked and studied on both sides of the Atlantic, James is a great believer in the importance of communicating across cultures and industries. Catch his work here on the Plecto blog, or as a guest contributor on other B2B websites.