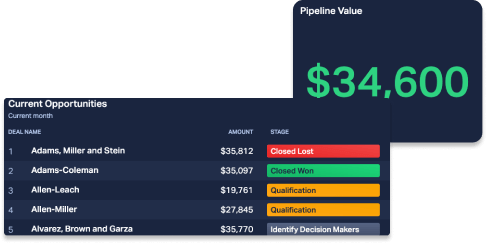

The Weighted Pipeline Value is a measure of sales forecasting, found by determining the likelihood of closing the deals you have at the moment. Because assessing the chances of closing a deal can be difficult, this KPI helps evaluate appropriate risk levels for your company’s pipeline.

One of the most valuable aspects of this KPI is its flexibility – you get to decide what percentage level of risk is acceptable at each stage of the sales pipeline, and define what “risk” or “success” means to begin with. So long as your standards are justifiable and consistent, your Weighted Pipeline Value will prove a powerful and valuable tool.

Weighted Pipeline Value is a useful KPI for your sales team to monitor.