While churn rate is generally considered a customer service metric, it can provide deep insight into your marketing and sales activities too. Understanding why customers churn allows you to focus on customer retention strategies at each stage in the lifecycle — from lead to prospect to customer.

In this article, you'll understand why customers churn, how to identify customers who are about to churn, and how to improve customer retention.

What is Customer Churn?

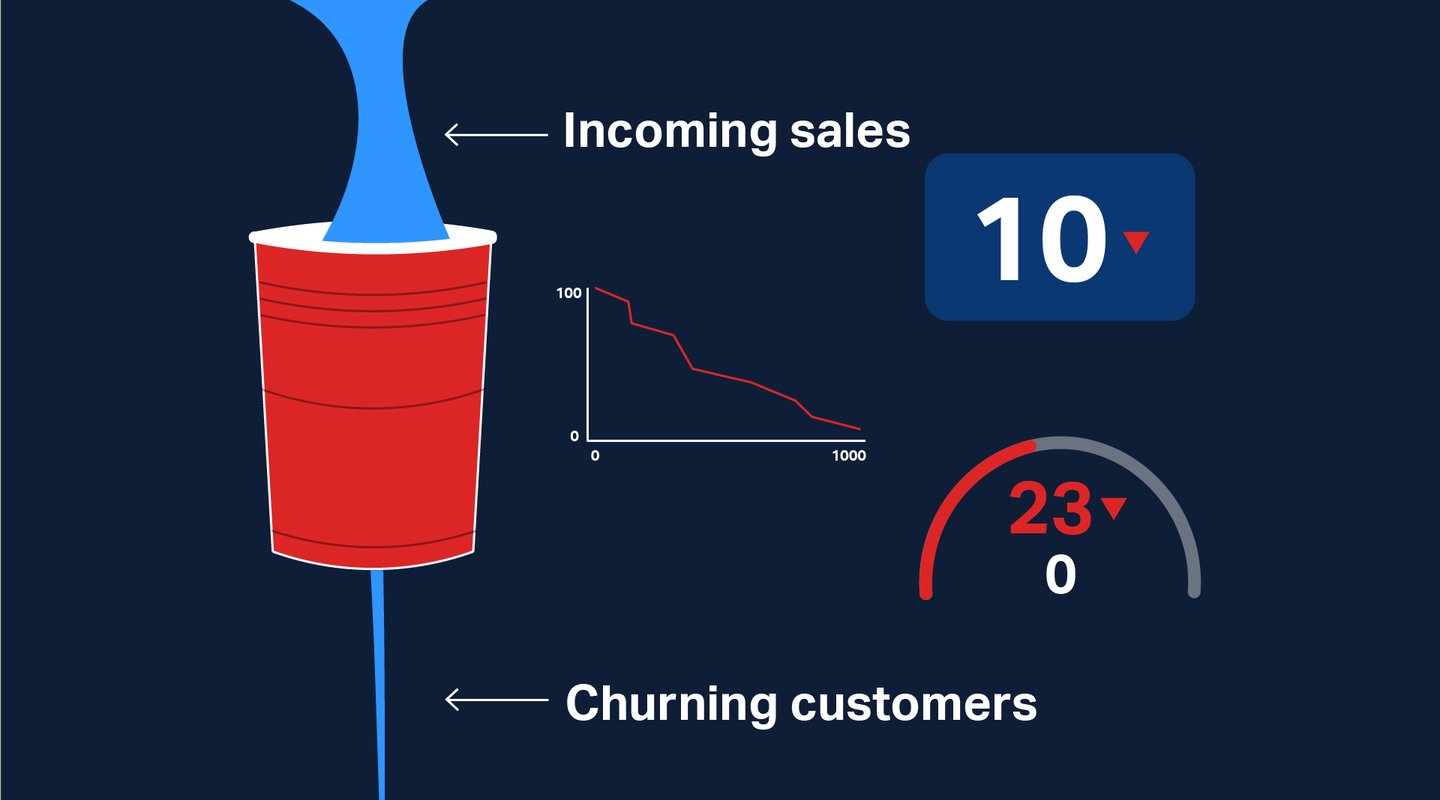

Regardless of your company’s size, industry, or business model, you should be keeping an eye on customer churn. Customer churn (or churn rate) is the number (or percentage) of existing customers who stopped doing business with your company during a specified period.

Customer churn falls into two main categories: Voluntary churn is when a customer actively decides to stop doing business with your company. Involuntary churn is circumstantial and usually attributed to payment issues (e.g., expired cards, declined payments, old payment information on file).

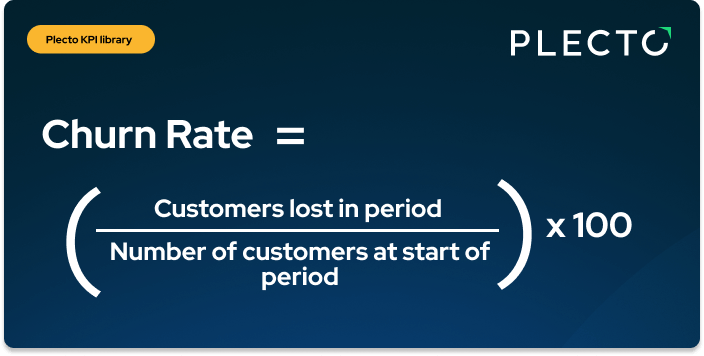

How to Calculate Customer Churn

It's pretty easy to find your churn rate: simply divide the number of customers you lost in the relevant period by the number of customers you had at the start of the period. Multiply by 100 to obtain a percentage.

Effects of Customer Churn

Churn rate is a crucial metric. Here’s why: If your company’s annual revenue is $200K, involuntary churn at the average rate could lead to $40K in lost revenue every year, slashing your company’s annual earnings in half in less than three years!

B2C companies usually experience higher customer churn than B2B companies — with some estimates coming in around 7% for B2C companies and 5% for B2B companies. In both cases, the average voluntary churn rate is around 60% while the involuntary churn rate is around 40%.

Customer churn is expensive! Some estimates say that existing customers are worth as much as seven times more to a company than new customers. Yet many businesses still focus on acquiring new customers instead of how to improve customer retention strategies for the ones they already have.

This presents two broad opportunities to reduce customer churn and improve customer retention – through preventative tactics and reactive measures. Understanding why customers churn and identifying red flag behaviors within your existing customers can help to save potential churns, and prevent future cases from following the same fate.

Read on to find out why customers churn, how to identify customers who are about to churn, and how to improve customer retention.

5 Reasons for Customer Churn + How to Prevent Them

Customer churn is unavoidable in business, but understanding why it happens can help you head some of it off at the pass. This means you can use preventative strategies to put a stop to churn before a prospect even puts pen to paper.

Here are five common reasons that people stop doing business with a company – and what you can do to prevent customer churn.

1. Closing the Wrong Deals

Sometimes sales reps are so focused on closing deals and hitting their quotas that they neglect to realize they’re courting the wrong customers. This is not about the common saying, ‘the customer is always right’ – but rather that the customer is not aligned with your brand or offer.

In the short term, the numbers may look great on paper – but in the end, the effort spent converting the incompatible customers would’ve been better spent on closing a customer who will benefit from your product and provide a better lifetime value. Want to learn how to have more meaningful sales interactions? Check out our article outlining how to focus on quality over quantity when prospecting.

Repeatedly selling to the wrong customers will eventually hinder your company’s growth, decrease revenue, and increase your churn rate. At best, you’re unlikely to upsell and retain customers who have bought a product that they didn’t fully understand and that doesn’t meet their needs. At worst, these customers may end up bad-mouthing your product – not because it’s a bad product but because the alignment between your offering and the customer’s need was never there.

How to prevent customer churn by closing the right deals

The right marketing can attract the right prospects – consider problem/solution-based messaging instead of feature-based promotions, in order to keep up with this it's best to visualize your campaigns with dashboards. This will give prospects a better understanding of whether your product suits their needs.

It’s also crucial to ask the right questions at the top of the sales funnel. Asking the right questions and listening to the answers will help you weed out prospects who aren’t a good fit for your business. Knowing what factors to analyze in the sales funnel can help you set those questions. In the long run, closing the right deals is far more important than closing any deal. How to improve customer retention over time is directly tied to acquiring the right customers in the first place!

2. Poor Customer Service

Research shows that up to 68% of customer churn is due to customers’ dissatisfaction with the service they receive. To make matters worse, these past customers will tell at least 10 people about their experience. This has a knock-on effect that will continue to damage your business long after the dissatisfied customer is gone.

How to prevent customer churn by improving customer service

Fortunately, poor customer service is pretty easy to fix – all you need to do is focus on training. Whether it’s part of your own employee’s onboarding process or they need a refresher course, there are always improvements that can be made.

Every customer should feel like their business matters to your company. Emphasize to your agents that every complaint should be handled quickly, politely, and proactively. From a consumer perspective, make it easy to contact customer service through various channels (e.g., phone, email, chat, and SoMe) and to leave messages outside of business hours. If it’s appropriate to your business, you might also provide self-service support tools.

Build your first dashboard.

Start your 14-day free trial today

3. Pricing and Unfulfilled Value

More than half of consumers say they’d pay more for better service and features. Does your product do what it promised? When customers see that they’re achieving the promised outcomes with your product, they’ll see its value and happily pay for it.

If your product is positioned as a premium solution without premium features, customers might flee to a lower-cost competitor offering a similar product. On the other hand, if customers perceive your product as too cheap relative to its promised value, they might not trust its ability to meet their needs.

How to prevent customer churn through pricing and value proposition

This goes back to using the right communication and closing the right deals. When qualifying your leads, your sales team should be taking a deep dive into what the customer needs – find out what product features are available to fulfill their needs, and whether your company is a suitable solution for them. It is important that whatever value the customer expects should be provided within a reasonable time.

When it comes to pricing, keep in mind that trends, economies, the market landscape, and customers’ needs will change over time. These factors could affect your customers’ willingness to pay what you’re asking, so it’s important to keep an eye on your pricing strategy and identify how it’s affecting your churn rate.

4. Difficult User Experience

How a customer perceives the value of your offering depends heavily on their user experience – was there any benefit for them and did they achieve their desired outcome? You’ll notice how each of these reasons why customers churn is most likely related to another – in this case, a customer’s experience can be impacted by poor customer service and value. Customer churn is highly likely if a customer perceives that a key feature of your product or service doesn’t seem to work effectively – for them.

How to prevent this?

Monitor customer experience (CX) visually on dashboards! When considering how to improve customer retention, customer service dashboards are an essential tool as they provide an in-depth analysis of customer satisfaction and your agent's customer service levels throughout the entire customer lifestyle. Want to know more about CX dashboards? For starters, first, learn how to create and use customer experience dashboards to support your customer retention strategies and reduce customer churn.

A bonus of visualizing your customer behavior and satisfaction on a data dashboard is that you are able to close the bridge between marketing, sales, and customer service. Having a comprehensive overview of the customer journey helps to identify where the disconnect occurred – as a lead, prospect, or customer. You can then rectify what you're doing to attract, convert or retain a customer and ultimately reduce customer churn rates.

For added customer retention insurance, you’ll want to ensure that your customers understand your product and how to use it. Help them understand the most important product features for their needs, and make sure they know where to find them and how to use them. Offering simple yet comprehensive self-help knowledge articles is a great way to guide customers through product setups. If you have the resources for it, dedicated customer success agents are perhaps the best way to make sure your customers are on track and enjoying your offering. Supporting your customers is every bit as important as acquiring them.

5. Payment Denied

We’ve just given you four common reasons for voluntary customer churn, so let’s end with the most common reason for involuntary customer churn — denied payments. There are various reasons that payments are denied, the most common one is an expired credit card but this can also be caused by payment processor issues or false fraud detection.

How to prevent customer churn by resolving payment issues

Mitigating involuntary customer churn can be as easy as sending reminders. If you offer a software product, consider embedding payment reminders within the product. Otherwise, a series of emails or time-triggered instant notifications can be quite effective. To optimize your email marketing - series of emails, follow these steps. Fortunately, if you’re providing a great product that delivers on its promises, your customers will happily pay for it – even if they need a little reminder.

5 Ways to Spot a Customer Who's Ready to Churn (and How to Retain Them!)

Some experts estimate that it costs as much as 25% more to acquire a new customer vs. keeping an existing customer from churning! Analyzing your existing customers behaviors is the perfect place to start when considering how to improve customer retention – it helps to identify any red flags indicative of customers who are getting ready to walk.

While this reactive approach allows you to act quickly to save your existing clientele and keep your churn rate in check, you will want to use these red flags to ensure future customer retention strategies go from reactive to proactive.

1. Look into your support ticket data

Your support tickets can tell you a lot about your customers’ satisfaction with your product. Customers with a high number of support tickets are likely to be dissatisfied or having trouble with your product. If you don’t do some damage control, you’re at risk of losing these customers and opening up your business to bad word-of-mouth.

Following up with customers who have unresolved issues or a high number of support tickets might be enough to get them on track and convince them that you value their business.

2. Have a look at your online customer engagement

Many businesses don’t bother to monitor these channels, which can be a treasure trove of information in the form of comments, questions, reviews, and feedback.

Social listening is just as important as your one-on-one conversations. Customers may not be as forthcoming in expressing their dissatisfaction directly if they are not given frequent opportunities to do so – for example, if you are unable to arrange regular meetings with them. This means keeping an eye on your ratings on G2 and Capterra, too. If your business has a social media presence, make sure that someone in your organization will monitor your platforms, for instance managing YouTube comments, and engaging with your customers.

3. You receive a poor Net Promoter Score (NPS)

Did you really think you’d make it through this whole article without mentioning the age-old customer loyalty metric? NPS is undoubtedly the easiest way to determine your customer’s satisfaction. It’s a clear-cut customer success KPI that asks customers, “How likely are you to recommend this company, product or service, representative, or experience to your friends, family, or colleagues?”

Make it easy for your customers to provide an NPS rating so you encourage your customers to provide feedback – whether they are at risk of churning or not. This way, you will have a straightforward measure of customer satisfaction that is communicated directly to your organization. Focus on what you can control. Reach out to those who have given you a low rating to find out what changes you can make – and act accordingly.

4. They change products or ask for a discount

Customers who are trying to ascertain whether your product is worth the cost might switch to one of your less-expensive products or ask for a discount. At this point, they’re probably looking into alternatives.

The best thing to do in this situation is to try to find out why your customer is asking for a discount or wants to change products. This is an excellent opportunity to highlight your product’s value and benefits. It can also be a good gauge of how other customers might be feeling.

5. Their usage or activity decreases

When a customer’s usage or activity starts to slip, they’re often on their way out. Activity patterns can tell you a lot about your customers’ level of engagement – or disengagement. Likewise, perhaps the biggest clue that you’re about to lose a customer is when they start scaling back their purchases by ordering less frequently or cutting services.

To help save these customers from churning, set red-flag metrics in your CRM system that identify customers whose activity has fallen below a threshold. Then reach out to and try to reengage them – send them personalized emails, pop-ups, and resources. Notifying customers about new features can be just the kind of rejuvenation they need to engage with your product or services again. Determine whether offering an incentive would generate a long-term mutually beneficial relationship – but a monetary discount should be your last resort.

Manage Your Customer Retention Strategies using Plecto

Customer churn is not always avoidable, but identifying possible defectors and acting as soon as possible is one of the most effective customer retention strategies in your toolbox.

Plecto can give you a real-time overview of your support channels to help you identify customers who have had a less than stellar experience – and act before it’s too late! Consolidate data from all your most important customer service, telephony, and CRM tools into one place. Check out our library of 100+ integrations to centralize and start visualizing your most important KPIs on customer dashboards to reduce churn and improve customer retention today!

Sign up for a FREE 14-day trial at Plecto – and watch your NPS skyrocket! 🚀