What is recurring revenue?

In recent years, and especially since the corona pandemic, companies everywhere have turned to subscriptions as their means of revenue generation. Especially in fields such as SaaS and online services, subscriptions to access products or services are now the primary mode of obtaining cash flow from customers.

In short, if a good or service can be turned into a subscription, it probably already has been! But why?

The answer is that subscription-based services generate recurring revenue. Recurring revenue is the money a company can reliably predict it will earn from regular, stable future transactions rather than just a single payment. Companies obtain this by locking customers into contracts that guarantee a high degree of user satisfaction.

In this article, we’ll dive into…

- The different types of recurring revenue

- The benefits of recurring revenue

- How you can leverage KPIs to increase your recurring revenue and expand your sales and market reach.

Recurring revenue models

There are several variants of the recurring revenue model, each with a particular relevance to a different sector or industry. A common element to all of these models is the use of pricing tiers, with each higher tier offering a wider selection of features for a correspondingly higher price.

Subscription model

In the subscription model, customers pay a regular fee to access a product or service. Fees are set for monthly or annual subscriptions, with occasional price raises to account for inflation or increased operating costs. Notable popular examples of the subscription model include Netflix (streaming) and Adobe Creative Cloud (SaaS).

Pay-as-you-go model

In a pay-as-you-go system, companies charge customers based on their frequency or amount of use. A good example of this is Amazon Web Services (AWS), which charges clients based on the amount of storage they use on the hosting platform. Another noteworthy example are telecom companies, which often charge customers for the variable amount of data or minutes they use per month.

Memberships

Professional associations and fitness centers are two common examples of membership-based subscriptions. Members pay a monthly or annual fee to access the benefits and services these centers or associations provide.

Consumable products and services

It’s not just SaaS and streaming—tangible goods can also be delivered under a subscription model. Consumable products such as Gillette razor blades and Nespresso coffee are just some of the goods routinely offered to customers on a usually-monthly subscription basis.

Freemium model

Highly common within apps and other software, the freemium model allows the user to download the “basic” version of the app or software for free, with the option to upgrade and pay on a recurring basis for more advanced features.

Build your first dashboard.

Start your 14-day free trial today

Recurring revenue benefits

Subscription-based recurring revenue models have increased in popularity for a reason—they offer significant benefits to consumer and merchant alike. Here are just a few of the reasons that recurring revenue has proven to be both popular and beneficial:

Increased cash flow

Companies that employ a recurring revenue model (unsurprisingly!) see more consumer-generated cash flow than those that don’t. This leads to several secondary benefits—for example, a focus on retaining customers rather than attracting new ones (which helps reduce sales and marketing costs too). Because this setup encourages stability, companies that use recurring revenue are also more attractive to investors.

Predictable revenue

Not only do subscription-based companies have more income, but this income is predictable. Whether it arrives on a monthly, quarterly, or annual basis, regular cash flow becomes a reliable and integral component of companies’ financial health and overall performance.

Customer loyalty and retention

Churn is the risk that comes with the reward of recurring revenue—and it’s an expensive risk indeed. So one of the premier aspects of a successful recurring revenue model is keeping customers loyal and happy, otherwise they’re at high risk of churning! Because companies occasionally raise their rates due to inflation and increased operational costs, it is vital that the product or service subscription is of high enough quality that customers are motivated to stay despite such price hikes.

Customer flexibility

Particularly with tiered pricing, customers have more opportunity to engage with a product or service, especially if purchasing it outright would be prohibitively expensive. Music streaming services such as Spotify are a good example of this principle in action—for a relatively small fee each month, customers can access a vast library of music that would otherwise be impossible to purchase.

Opportunity for up- and cross-selling

Finally, a recurring revenue model offers significant potential for modifying your customers’ contracts. Upselling is the practice of offering your customers a higher grade of the same product or service. Cross-selling is the practice of offering them a bonus or additional benefit to further enhance their user experience. With enough convincing—and the quality assurance to boot—a medium-tier subscription can become a large, for example. Enough upsells and cross-sells will generate your company a large amount of additional revenue.

Using KPIs to boost recurring revenue

Knowledge is power. Because they provide immediate insights into your business performance, KPIs are some of the most valuable tools you can use to monitor your recurring revenue—and increase it.

When visualized as widgets on a data dashboard, KPIs have immense potential to bring these revenue-oriented insights to life. Below are some examples of relevant KPIs you can use to track and optimize your recurring revenue.

New MRR

New MRR (Monthly Recurring Revenue) is an essential KPI for any business run on a subscription basis, as it measures the amount of new revenue generated from subscriptions every month. New MRR provides a quick “temperature check” about your company’s financial, sales, and marketing performance: if you’re consistently adding new customers while minimizing downgrades and churn, your New MRR statistic will reflect this directly.

LTV

LTV, short for Lifetime Value, measures the total amount of revenue you can expect to receive from one customer through their entire “lifetime” (product purchase through account termination) with your company. LTV is hugely important in determining the costs of churn, for example. Monitoring LTV is key to projecting and forecasting customer-based revenue growth, while also ensuring you are maintaining—and increasing—your revenue pool of customers and leads.

ARR

While MRR is focused on the here-and-now, ARR (Annual Recurring Revenue) is a yearlong projection based on current MRR. Because it doesn’t consider the ups and downs of monthly revenue fluctuation, it’s useful to have on hand as a general statement or summary of overall financial performance per annum. However, be warned that ARR being based on a single month of MRR can create inconsistencies between actual and projected revenue.

CSAT

One of the most important KPIs out there—not just for recurring revenue, but in general—CSAT is essential for tracking how (you guessed it!) how satisfied your customers are with your product or service. Find CSAT by asking your customers to rate their experience on a scale of 1-10 (or 1-5). “Satisfied” customers are those with a score of 8+ (or 4+). Unlike NPS, CSAT measures only particular aspects of the customer experience, not likelihood of recommendation to others. Monitoring this KPI is key to gauging consumer mood, and will let you know if any of your customers are at risk of churning.

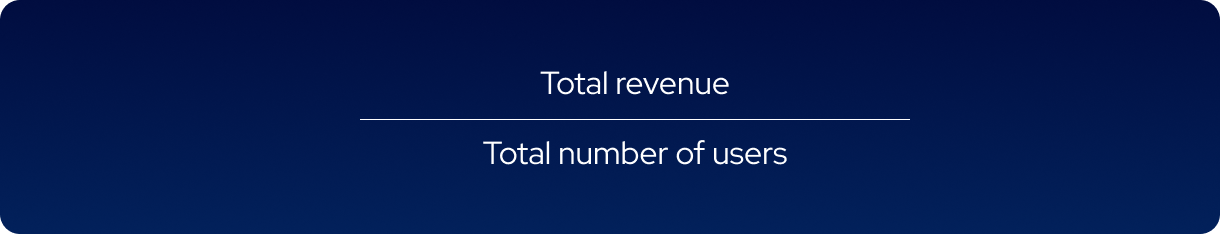

ARPU

Average Revenue per User, or ARPU, is something of a controversial addition to this list. It measures the amount of revenue generated by each of your customers, and is found by dividing your total revenue by your number of customers. There’s no clear guidance about what should count as “revenue” in this calculation, and upselling customers (thereby generating more revenue) while keeping the same number of customers leads to a higher ARPU—and therefore more positive attention.

However, we don’t want to totally delegitimize this metric. Instead of taking it as gospel truth, use it as a rough estimate to see how you’re doing with revenue generation, and drill down your data with more comprehensive—and precise—KPIs.

Conclusion

Recurring revenue has proven to be a highly effective means for companies to increase their margins and cash flow. It’s also proven to be highly effective for attracting and retaining consumers, giving them access to products and services at a great value. The very nature of the recurring revenue model prompts companies to keep the quality of their offerings high while providing exemplary service to customers.

Tracking KPIs oriented toward recurring revenue has never been easier with Plecto’s dashboard software. If you need immediate insights into your customers’ well-being or your monthly financial performance, or if you want to track long-term revenue goals, Plecto dashboards make these activities both simple and engaging. Try it free for 14 days, and see for yourself how Plecto can help you reach your subscription revenue goals!

JAMES NIILER

Content Specialist

An in-house content writer and specialist at Plecto, James brings an academic touch and journalistic flair to his marketing copy. Having worked and studied on both sides of the Atlantic, James is a great believer in the importance of communicating across cultures and industries. Catch his work here on the Plecto blog, or as a guest contributor on other B2B websites.