Working in the insurance industry and struggling to retain your employees? You're not alone! Recent research has shown that employee retention rates in the insurance industry range between 12% and 15%, with voluntary turnover rates on the rise. Increasing voluntary turnover rates can result in increased costs, decreased productivity, and talent loss. But don't stress! In this blog post, we will discuss tried-and-true methods for increasing employee retention in the insurance industry so that you can retain your valuable employees in the highly competitive insurance market.

The Importance of employee retention in the insurance industry

Employee retention is critical in any industry, but it is especially critical in the insurance industry. Top talent is the backbone of insurance companies' success in the market. Employees with experience and knowledge help build customer loyalty and trust while also driving revenue growth. High employee turnover rates, on the other hand, can be extremely costly in terms of resources and time. Recruiting, hiring and training new employees is expensive, not to mention that it can take some time before they reach their full potential.

Furthermore, high employee turnover rates in the insurance industry can have a negative impact on remaining employees morale, leading to voluntary resignations. By investing in employee retention strategies, insurance companies can reduce turnover rates, boost company morale and productivity, and build a strong and successful team that can compete effectively in the highly competitive insurance industry arena.

So, if you want to build a long-term and profitable insurance company, it's time to prioritize employee retention. Continue reading to learn about the top five strategies for increasing employee retention in the insurance industry!

1. Provide competitive compensation and benefits.

Attracting and retaining top talent in the insurance industry means providing more than just a standard paycheck. Competitive compensation and benefits packages are critical for building a strong and loyal team that can contribute to a company's success.

Furthermore, employees want to feel valued and appreciated, and providing generous benefits is one of the best ways to do that. You can include health insurance, retirement plans, or extra paid vacation days in the compensation and benefits plan, which are the most advantageous options for employees.

Having competitive benefits for employees can help build trust and loyalty among them, making them feel secure and stable. In turn, this can lead to increased job satisfaction and productivity and bring enormous success to your insurance company's growth!

Build your first dashboard.

Start your 14-day free trial today

2. Offer professional development and career growth opportunities.

If you want to keep your employees engaged and motivated in the insurance industry, you must provide professional development and career growth opportunities. Employees want to feel valued, supported, and invested in their future development. By providing training opportunities for employees, you will not only ensure that they are up to date on the latest insurance trends, but you will also help them reach their full potential.

On-the-job training and mentorship, as well as formal education and certification programs, are all examples of professional development. Professional development will provide your team with the valuable skills and knowledge required to excel in the insurance industry. Furthermore, career advancement opportunities are critical in increasing employee retention in the insurance industry. Offering opportunities for career advancement, such as promotion to a higher position or job rotations, can make your employees feel important and valued.

3. Foster a positive company culture.

Employees are an important part of the insurance industry because they interact with customers, handle claims, and keep the company's operations running smoothly. As a result, it is critical to cultivate a positive company culture in order to increase employee retention in the insurance industry.

The reasons why companies need to foster a positive company culture are simple. Positive company culture leads to happy and engaged employees, who are more likely to stay for longer and become loyal employees. Negative company culture can lead to high turnover rates where even the brand’s reputation can suffer, which can affect sales and profitability.

For example, you can foster a positive work environment by prioritizing employee well-being and providing flexible work hours as well as adequate vacation time. The team also has a significant impact on company culture. Encourage team-building activities and social events, which can strengthen employee relationships and lead to increased job satisfaction.

4. Encourage work-life balance.

We live in a fast-paced world, and striking a work-life balance can be difficult for many employees, particularly those who are in the insurance industry. Long hours, tight deadlines, and high-pressure work can quickly wear employees out, affecting their mental and physical health. That is why, now more than ever, insurance companies must prioritize work-life balance in order to increase employee retention in the insurance industry.

Employees who feel that their employer values their personal lives are more likely to stay longer with the company. By having a work-life balance, employees can stay more productive, engaged, and motivated. How can you encourage work-life balance for your employees? There are many options; for example, you can suggest flexible work schedules for employees. This includes compressed workweeks and flexible start and end times. By giving employees ownership of their work schedules, they can better balance their work and personal responsibilities.

Offering remote work opportunities is another way to encourage work-life balance. As many employees have grown accustomed to working from home, this has become an increasingly popular trend in the COVID-19 pandemic. Insurance companies can provide employees with more flexibility and reduce the stress of commuting to the office by offering remote work options.

5. Listen to your employees' feedback

Encouraging employee feedback is one of the most crucial strategies for having high retention rates at your insurance company. It’s easy to overlook important details about employee feedback, which with time can lead to a decrease in job satisfaction and higher employee turnover.

There are some strategies for preventing voluntary employee loss. For example, sometimes take time to listen to your employees' concerns through weekly check-ins, surveys, or suggestion boxes. Remember - make sure that your employees know that their feedback will be taken seriously and that the required changes will be implemented as soon as possible. This will show that you value your employees' opinions and demonstrate a commitment to continuous

Increase employee retention in the insurance industry with Plecto!

In this article, we discussed the five most powerful strategies that will increase employee retention in the insurance industry. High turnover rates can negatively affect brand image and resources, which can create obstacles to the company’s further development. You can become proactive with Plecto, a powerful software tool that can help increase employee retention in the insurance industry.

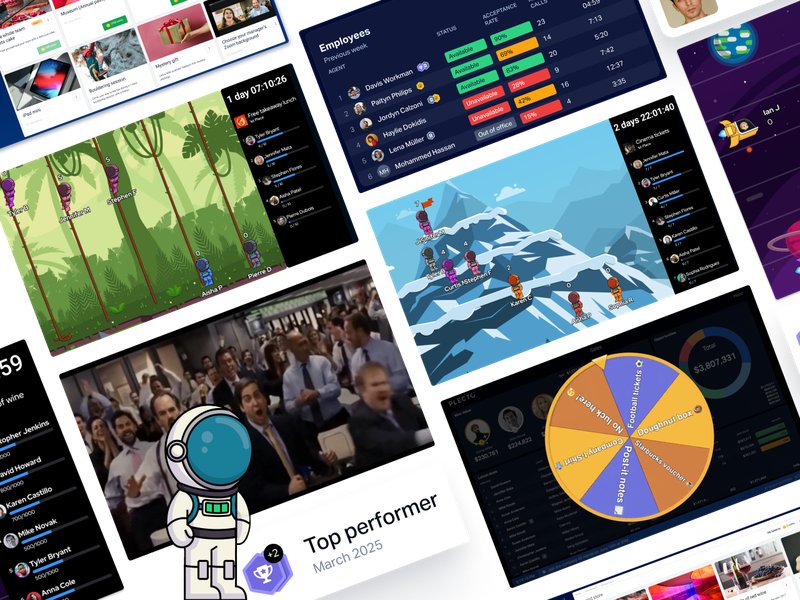

By utilizing Plecto, insurance companies can create a more productive and motivating work environment for their employees. With the aid of engaging gamification features, it is simple to set up a quick competition among team members and spark that motivation. By making work fun, employees are more likely to remain engaged and motivated, resulting in greater job satisfaction and retention!

However, the team is not about dividing weak and strong members; the goal is to create the most powerful team possible. By adding 1:1 meeting sessions with your employees, you can easily identify what needs to be improved and what personal coaching employees need!

Plecto is an all-in-one performance management platform that provides real-time data visualization and gamification tools to help motivate and engage employees. By using Plecto, insurance companies can create a more productive and rewarding work environment that encourages employees to stay with the company for the long term.

Take a 14-day free trial and see how it can help boost employee retention in the insurance industry!